No products in the cart.

Common Size Balance Sheet Analysis Format, Examples

It can be sold at a later date to raise cash or reserved to repel a hostile takeover. Retained earnings are the net earnings a company either reinvests in the business or uses to pay off debt. Some liabilities are considered off the balance sheet, meaning they do not appear on the balance sheet. A liability is any money common size balance sheet example that a company owes to outside parties, from bills it has to pay to suppliers to interest on bonds issued to creditors to rent, utilities and salaries. Current liabilities are due within one year and are listed in order of their due date. Long-term liabilities, on the other hand, are due at any point after one year.

What Is the Balance Sheet Formula?

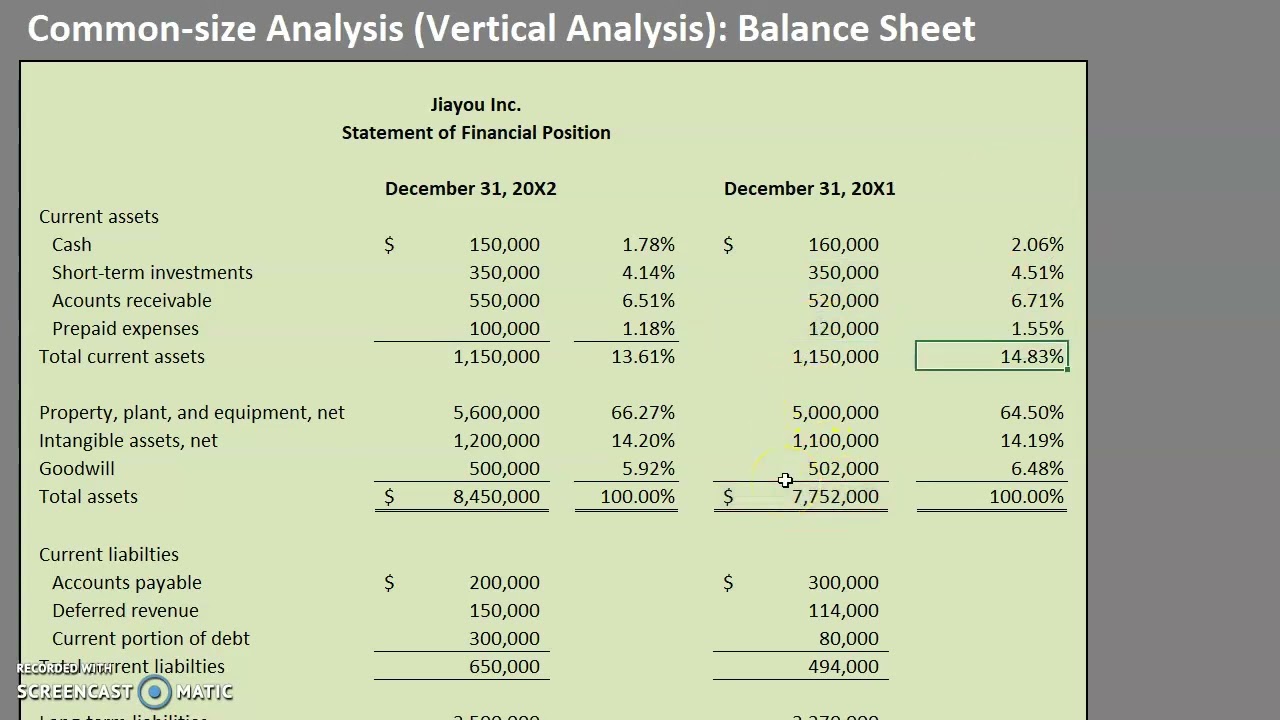

To elaborate, not only can a user effortlessly see how well a company’s capital structure is allocated, but they can also compare those percentages to other periods in time or to other companies. A common size balance sheet helps in evaluating a company’s asset structure, liabilities, and equity in relation to total assets, which simplifies comparison between companies of different sizes. Assets, liabilities and equity are presented as a percentage of total assets or total liabilities and equity. It helps understand the nature of a company’s asset structure and sources of capital. The main difference is that a common size balance sheet lists line items as a percentage of total assets, liability, and equity, which is different from the normal numerical value. One of the best examples of a common size financial statement is to take a look at the sales revenue on an income statement.

What Is a Common Size Financial Statement?

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more. The key benefit of a common-size analysis is that it allows for a vertical analysis by line item over a single period, such as quarterly or annually. It also allows you to view a horizontal perspective over a period such as the three years that were analyzed in our example. It’s worth noting that if two companies are using different accounting methods the comparisons might not be accurate. Regardless of the size of a company or industry in which it operates, there are many benefits of reading, analyzing, and understanding its balance sheet.

Common size balance sheet analysis

- The main difference between a normal balance sheet and a common size one is that percentages are included next to the numeric values, showing the proportion of each line item as a percentage of total assets.

- They are divided into current assets, which can be converted to cash in one year or less; and non-current or long-term assets, which cannot.

- That’s because a company has to pay for all the things it owns (assets) by either borrowing money (taking on liabilities) or taking it from investors (issuing shareholder equity).

- We earn almost 11 cents of net income before taxes and over 7 cents in net income after taxes on every sales dollar.

- Note that although we have compared just two years of data for Charlie and Clear Lake, it is more common to use several years of data to get a more robust view of long-term trends.

Note that rounding issues sometimes cause subtotals in the percent column to be off by a small amount. This tool is especially important if you’re using key performance indicators to measure your business’s performance and profitability. The approach lets you compare your business to your competitors’ businesses, regardless of size differences. The goodwill level on a balance sheet also helps indicate the extent to which a company has relied on acquisitions for growth. This table shows how each element contributes to the company’s revenue structure, aiding in quick assessments.

How Balance Sheets Work

The common-size balance sheet functions much like the common-size income statement. Each line item on the balance sheet is restated as a percentage of total assets. The common size balance sheet reports the total assets first in order of liquidity. Liquidity refers to how quickly an asset can be turned into cash without affecting its value. For this reason, the top line of the financial statement would list the cash account with a value of $1 million.

Link to Learning: Common-Size Assets and Common-Size Liabilities and Equity

Depending on the company, this might include short-term assets, such as cash and accounts receivable, or long-term assets such as property, plant, and equipment (PP&E). Likewise, its liabilities may include short-term obligations such as accounts payable and wages payable, or long-term liabilities such as bank loans and other debt obligations. Notice that PepsiCo has the highest net sales at $57,838,000,000 versus Coca-Cola at $35,119,000,000. Once converted to common-size percentages, however, we see that Coca-Cola outperforms PepsiCo in virtually every income statement category. Coca-Cola’s cost of goods sold is 36.1 percent of net sales compared to 45.9 percent at PepsiCo.

XYZ has stability and better profitability, so seemingly it may be a better long-term alternative.

We believe everyone should be able to make financial decisions with confidence. Limitations include a lack of context on absolute values, inability to reflect industry norms, and minimal insight into non-operational factors. This analysis indicates that 40% of the revenue is consumed by production costs. The basic objective of a Common-size Balance Sheet is to analyse the changes in the individual items of a Balance Sheet. You can also prepare for the other statements, but that would not be as perfect and informative as these two statements could be.

For small privately-held businesses, the balance sheet might be prepared by the owner or by a company bookkeeper. For mid-size private firms, they might be prepared internally and then looked over by an external accountant. Last, a balance sheet is subject to several areas of professional judgement that may materially impact the report. For example, accounts receivable must be continually assessed for impairment and adjusted to reflect potential uncollectible accounts.

The information can be compared to competitors to see how well it is performing. A balance sheet explains the financial position of a company at a specific point in time. As opposed to an income statement which reports financial information over a period of time, a balance sheet is used to determine the health of a company on a specific day. A company will be able to quickly assess whether it has borrowed too much money, whether the assets it owns are not liquid enough, or whether it has enough cash on hand to meet current demands. If a company takes out a five-year, $4,000 loan from a bank, its assets (specifically, the cash account) will increase by $4,000.